Mindful Budgeting That Works

Let’s Get One Thing Straight: You’re Not Broke Because of Lattes

You've been lied to. A lot.

If you’ve spent any time on social media lately, you've probably seen the same tired financial advice recycled over and over:

“Stop buying Starbucks.”

“Ditch avocado toast.”

“Cut subscriptions and you’ll be wealthy.”

The people saying this? They’re often filming from a luxury apartment they didn’t pay for, talking about how you should save $3 a day while they sell you a budgeting journal or digital planner for $47. Cute.

Budgeting, according to this tribe of online money whisperers, is all about eliminating fun, living in scarcity, and feeling bad for every tiny purchase that isn’t 100% “essential.”

Let’s set the record straight: Budgeting shouldn’t feel like punishment.

Real Talk: Budgeting Isn’t Cute, It’s Calculated

At RealCoolNews, we don’t glamorize budgeting. We respect it.

Because done right, budgeting isn’t about restriction—it’s about control. It’s how you turn financial chaos into clarity. How you go from paycheck-to-paycheck panic to knowing where your money is, what it’s doing, and how to make it work for you.

Mindful budgeting is like GPS for your money. It's not there to ruin your road trip—it’s there to keep you from driving off a cliff.

🚫 Budget Advice That Belongs in the Trash

Before we get to what works, let’s talk about what doesn’t. Because there’s a lot of bad budgeting advice out there.

Here’s a quick list of tactics that sound smart but usually backfire:

❌ Freeze your credit card in a block of ice

This isn't a sitcom. Credit cards are tools, not enemies. Instead of freezing them, learn to manage them. Responsible use builds credit, which you’ll actually need for big life things—like buying a home or financing a car.

❌ “Get a side hustle!”

Not inherently bad advice—but it assumes you’ve got endless time and energy. For many, working a second job just leads to burnout without solving the root issue: bad money management.

❌ Cash-stuffing envelopes

This TikTok trend looks aesthetic, sure. But it’s not 2005. Most of life is digital, and your landlord is not accepting cash envelopes with pink stickers.

❌ The 5-account rule

Having five checking accounts to “force discipline” sounds more like a part-time job. Complication doesn’t equal control. Simplicity is your friend.

Real Cool POV: Budgeting Is a Power Move

Think of budgeting like meal prepping. You might not love it while you're doing it, but future-you? They’re thriving. Same with money. Done right, it gives you options. The option to leave a job. Say yes to a weekend trip. Cover emergencies without spiraling.

It’s not flashy, but it’s real. It’s also not about being perfect—it’s about being intentional.

Here’s how to make that happen.

5 Smart Budgeting Moves That Actually Work

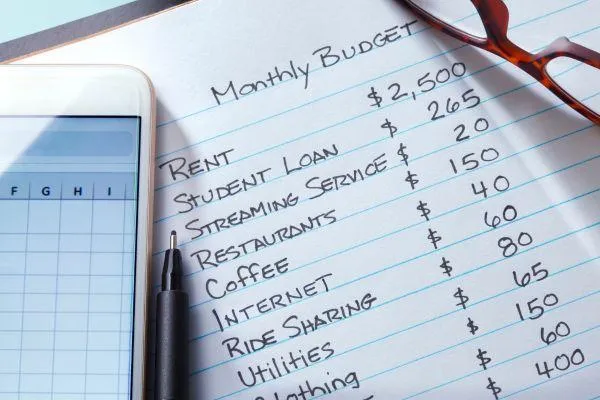

1. Know Your “Baseline Budget” (a.k.a. Your Minimum Mode)

Start with the number you need to survive—bare minimum.

Rent or mortgage

Utilities

Food

Transportation

Debt payments (if any)

This is your Baseline Budget. Knowing this number isn’t limiting—it’s empowering. It’s your bare bones number to keep you afloat. When you know that number, everything else is a choice.

Pro tip: Once your essentials are covered, you stop budgeting from a place of fear and start budgeting from a place of strategy.

2. Automate the Important Stuff (Not Just the Bills)

Most people automate Netflix and forget their savings.

Flip that.

Use automation to prioritize your goals—emergency savings, investing, travel fund. The idea is to move money before you see it.

Why it works: You remove decision fatigue. If money leaves your checking account before you can second-guess it, you’re saving without even trying.

3. Ditch 50/30/20—Try 70/20/10 Instead

The 50/30/20 rule is a classic—50% needs, 30% wants, 20% savings. But for a lot of people (especially in high-rent cities), 50% barely covers rent.

Try this instead:

70% Needs + Lifestyle

Realistic coverage for rent, bills, food and a little room to breathe.20% Goals

This is your savings, investments, debt payoff—your “get ahead” bucket.10% Joy Money

Spend it however you want. Yes, even on iced coffee and concert tickets.

This isn’t about restriction. It’s about realistic allocation that leaves room for living.

4. Budget Weekly—Not Monthly

Life doesn’t happen in 30-day cycles. Neither should your budget.

Weekly budgeting helps you spot issues faster. It also helps you course-correct in real time. That $200 impulse buy? You’ll notice it next Monday, not 25 days later when you’re overdrawn.

Try a quick 10-minute check-in every Friday or Sunday. Call it “Money Moments.” Track what came in, what went out, and what’s left. That’s it. Light a candle. Make it a vibe.

5. Create a “Walk-Away Fund” (Your Freedom Money)

This isn’t just a rainy-day stash. This is your freedom fund.

It’s the money that lets you:

Say “no thanks” to toxic work

Move out from a bad roommate

Take a break when life gets too heavy

Seize a cool opportunity that comes out of nowhere

It doesn’t have to be big. It just has to exist. Even $500 can change how you walk into a room when you know you’re not stuck.

Start with a goal: maybe $1,000. Add $10 a week. Build it slowly. But protect it like your peace.

Bonus Move: Treat Budgeting Like Self-Care (Because It Is)

Budgeting isn’t a punishment for not being rich yet. It’s a form of respect—for your time, your energy, and your future.

When you budget, you’re not “limiting yourself.” You’re choosing clarity over chaos.

So, make it feel good:

Use an app that’s easy on the eyes (not just the numbers)

Set money dates with yourself or your partner

Celebrate small wins—like hitting a savings goal or staying under budget for the week

Make it sustainable. Make it yours. Just make it happen.

The Wrap-Up: Budgeting Won’t Go Viral—But Your Stability Might

Here’s the tea: budgeting isn’t trendy. It’s not glamorous. You won’t get a million likes for tracking your expenses. But you will get peace of mind, options, and momentum.

You’ll sleep better. Walk taller. Stress less when life gets weird.

That’s not just budgeting—that’s strategy.

So no, you don’t need to become a spreadsheet-obsessed minimalist who reuses tea bags.

You just need to take control of your money on purpose.

And that? That’s about the coolest thing you can do.

RealCoolNews.com — Smart money moves. No shame. No fluff. All control.

If you want more brain power than your smartass best friend, check out and read some of the books we recommend from the 📚 Best Sellers Reading List 📚